Bank Indonesia Cuts Interest Rate, Zero DP Requirements for Property & Vehicles

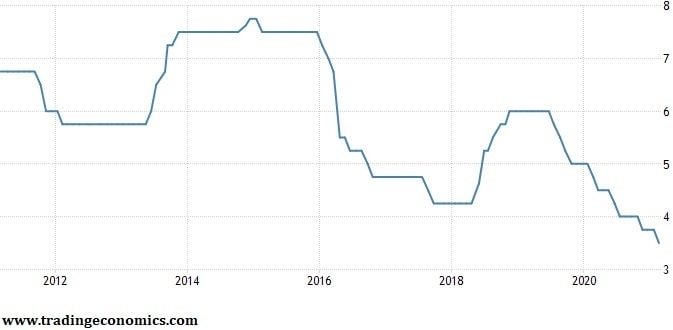

At its latest monetary policy meeting, which ended on 18 February 2021, the central bank of Indonesia (Bank Indonesia) decided to cut its benchmark interest rate (BI 7-Day Reverse Repo Rate), again, by 25 basis points (bps) to 3.50 percent, touching a historically low level.

By doing so, Bank Indonesia reconfirmed its accommodative policy stance. However, it is also a clear signal that the negative impact of the COVID-19 crisis on the Indonesian economy is far from over, despite several ministers (including Coordinating Minister of Economic Affairs Airlangga Hartarto) expecting to see the return of positive economic growth, on an annual basis, in the first quarter of 2021.

In that context, it is also interesting to mention that Bank Indonesia cut its forecast for Indonesia’s economic growth in full-year 2021 from the range of 4.8 – 5.8 percent year-on-year (y/y) to the range of 4.3 – 5.3 percent (at the February 2021 monetary policy meeting) after seeing the contraction of -2.19 percent (y/y) in the fourth quarter of 2020. This shows that Bank Indonesia has become a bit less optimistic about the economic conditions in 2021.

Bank Indonesia's Benchmark Interest Rate:

Moreover, besides cutting the key interest rate again, Bank Indonesia also provided another big incentive in an attempt to boost economic activity: it cut the down payment (DP) requirement for purchases of property and automotive vehicles (cars and motorcycles) to zero percent, meaning Indonesians have the opportunity to purchase their dream house or car without using a DP at all (in case the purchase involves a bank loan). This incentive will become available per March 2021, and is targeted to last until the end of 2021.

This incentive is great news for Indonesia’s property and automotive sectors. But what is quite interesting is that Bank Indonesia seems eager to boost economic growth 'at any cost'. Typically, when an economy is recovering from a crisis, sectors that rebound first are the banking sector, followed by mining and commodities as the economic rebound requires plenty of energy and raw materials. Afterwards, several other sectors typically follow this rebound, namely property, automotive, and tourism.

However, the ongoing COVID-19 crisis, which involves a range of social and business restrictions, has kept economic activity at a minimum so far, reflected by three straight quarters of negative economic growth between Q2-2020 and Q4-2020 (pushing the Indonesian economy into a recession along the way). Yes, we see negative growth easing after Q2-2020 (on an annual basis), but we are still in the red territory; which may persist into Q1-2021.

Bank Indonesia now seems willing to burden the nation’s banking sector by allowing zero DP requirements for property and automotive purchases in an attempt to boost economic activity. Unlike a sector such as tourism, these two sectors are not regarded COVID-19 hotspots and can therefore be encouraged with limited risks. However, it will be interesting to monitor the impact of these incentives on Indonesia’s banking industry (for example whether it will lead to a significantly higher Non-Performing Loan ratio, or NPL ratio).

Property Incentives as a Game Changer

Having zero DP requirements on property purchases (residential property that is, such as landed houses, apartments and shop houses/office houses) seem more worthy of attention than the case of zero DP requirements for car or motorcycle purchases considering there is a serious housing backlog in Indonesia. With home ownership demand estimated at 11.4 million, there is huge demand for property; demand that cannot be met by supply.

However, just like the phrase "terms and conditions apply" that is often present in small letters when we see an attractive offer on a billboard or commercial, Bank Indonesia also set a couple of terms and conditions related to these zero DP requirements.

The most important one being that not all banks can freely provide house ownership credit (in Indonesian: Kredit Pemilikan Rumah, abbreviated as KPR) and apartment ownership credit (Kredit Pemilikan Apartment, KPA) with a zero percent DP. Bank Indonesia Director of Macroprudential Policy Yanti Setiawan said only banks with non-performing loan (NPL) ratios below five percent are allowed to freely provide these zero DP KPR/KPAs.

Indonesian Banks with NPL Ratio Below 5 Percent (Q4-2020):

| Bank | NPL Ratio |

| Bank Rakyat Indonesia (BRI) | 2.99% |

| Bank Negara Indonesia (BNI) | 4.25% |

| Bank Mandiri | 3.29% |

| Bank Tabungan Negara (BTN) | 4.37% |

| Bank Central Asia (BCA) | 1.79% |

| Bank Panin | 3.05% |

| CIMB Niaga | 3.89% |

| Bank Danamon | 2.84% |

| Bank Permata | 3.78% |

This requirement generally limits banks that can participate in zero DPs to those categorized as BUKU IV (and some BUKU III) banks. However, Bank Indonesia also provided some room for banks that do not meet the NPL standard to participate. Banks with a NPL ratio higher than 5 percent can lend credit provided the debtor is (1) a first-time home buyer, and (2) the property is limited to the 'minimalist type' (namely property with a maximum size of 21 m2).

BUKU System Indonesia:

| Category | Core Capital |

| BUKU I | < IDR 1 trillion |

| BUKU II | IDR 1 trillion - IDR 5 trillion |

| BUKU III | IDR 5 trillion - IDR 30 trillion |

| BUKU IV | > IDR 30 trillion |

Easing Regulations in Property May Pose Challenges for the Banking Industry

This policy can be appreciated because on the one hand it can be regarded ‘pro-people’, in particular for the lower middle class who do not own a house yet. But it also provides opportunities for people who are interested in property investment. So, the property sector should be happy about this and become more willing to invest in new projects.

And what about the banking industry of Indonesia? Are they happy seeing the new Bank Indonesia policy? Perhaps not too much. In Bank Indonesia’s announcement on 18 February 2021, Bank Indonesia Governor Perry Warjiyo in fact urged state-owned banks to cut their credit rates as soon as possible. The problem is that while Bank Indonesia has cut its benchmark rate by 250 bps (from 6.00 percent to 3.50 percent) over the past 18 months, the gap with banks’ prime lending rates (SBDK) is still very wide, and this gap is in fact highest for state-owned banks.

It is therefore also not surprising that existing KPR interest rates have difficulty coming down from two digit figures. In 2020, the SBDK for KPR credit was 9.70 percent.

Considering the ongoing pandemic in 2021 and, of course, the prudent nature of Indonesian banks (seeking to prevent bad credit), it is even possible that banks will simply raise their interest rates in response to KPR/KPA credit with a DP of zero percent.

This column was written by Elizabet Siregar, a journalist - focused on economic and political news - with over 12 years experience working in Indonesian media.