Economic Update Indonesia; Assessing the Economy by Looking at Macroeconomic Indicators

In this article we take a look at the strength of the Indonesian economy by assessing a variety of macroeconomic indicators such as retail sales, consumer confidence, and credit growth.

To remind the reader, in the first quarter of 2023 (Q1-2023) Indonesia’s economic growth reached 5.03 percent year-on-year (y/y), which was a positive result (yet in line with expectations) thanks to strong household consumption and exports.

It is also useful to separate domestic conditions from external conditions because in terms of conduciveness there seems to be a bit of contrast between both, in the sense that the global environment remains much more challenging. When we take a look at a few recent statements from international organizations we quickly get the gist:

- “Global growth has slowed sharply and the risk of financial stress in emerging market and developing economies is intensifying amid elevated global interest rates” (World Bank’s Global Economic Prospects, June 2023).

- “The global economy is showing signs of improvement but the upturn remains weak, amid significant downside risks” (OECD Economic Outlook, June 2023).

- “The outlook is uncertain again amid financial sector turmoil, high inflation, ongoing effects of Russia’s invasion of Ukraine, and three years of COVID” (IMF’s World Economic Outlook, April 2023).

When we read recent publications of these institutions, then the main points are that the global economy remains in a precarious state amid a series of overlapping effects and shocks stemming from the COVID-19 crisis, the Russo-Ukrainian war, the sharp tightening of monetary policy, structurally elevated inflation, and the recent banking sector stress. It are all matters that trigger a decline in global economic activity, and therefore global economic growth is projected to slow significantly in the second half of this year, with weakness continuing in 2024.

In fact, at the moment, central bankers (specifically in the United States) seem ready to raise interest rates further to combat structurally high inflation. Rising borrowing costs in these advanced economies could lead to financial dislocations in the more vulnerable emerging market and developing economies. And, recent banking sector stress in the advanced economies could result in more restrictive credit conditions, which would likely dampen economic activity.

And we are already seeing what can happen. Germany, which is the economic engine of Europe, has already entered a technical recession. Meanwhile, according to HSBC Asset Management, the US will enter a downturn in Q4-2023, followed by a “year of contraction and a European recession in 2024. With a number of advanced countries being in or close to a recession (and Japan just having exited an economic recession), it obviously is a very challenging external environment.

In the case of Indonesia, we know that the country is somewhat isolated from the global supply and value chains. And so, in times of global economic turmoil, it cannot suddenly tumble into red figures, nor will the Indonesian economy soar in times of global recovery. Instead, Indonesia has this great consumer force at home on which it can (heavily) rely (with a population that numbers around 275 million people).

Nonetheless, Indonesia is not completely immune to external factors, most notably international commodity prices. In terms of exports, Indonesia is highly dependent on commodities (especially coal and palm oil). So, when global turmoil pushes these prices down, Indonesian exports experience a severe hiccup.

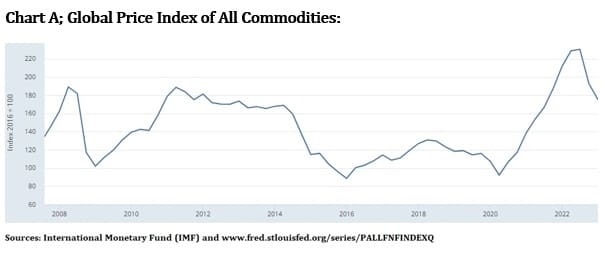

In chart A we can see that global commodity prices soared into Q3-2022 (to record high territory), thus allowing Indonesia to set record-high trade surpluses (which also supports the current account balance, rupiah rate, and foreign exchange reserves). After Q3-2022, however, a steep decline has been ongoing. Yes, commodity prices remain at levels that are elevated in historical perspective, but this could end soon. In May 2023 Indonesia’s trade surplus had largely vaporized, and it might need to face monthly trade deficits soon (thus putting pressures on the current account, rupiah, and foreign exchange reserves).

[...]

This is the introduction of the article. The full article is available in our June 2023 report. This report (an electronic report) can be ordered by sending an email to [email protected] or a message to +62.882.9875.1125 (including WhatsApp).

Take a glance inside the report here!

Price of this report:

Rp 150,000

USD $10,-

EUR €10,-

Bahas

Silakan login atau berlangganan untuk mengomentari kolom ini