Currency of Indonesia: Rupiah to Appreciate in 2016

After six years of steady decline, the Indonesian rupiah is likely to have appreciated against the US dollar at the end of 2016. So far this year, the currency of Indonesia has appreciated 4.8 percent to IDR 13,126 against the greenback (Bloomberg Dollar Index) supported by capital inflows, particularly into government bonds and stocks as well as the delay in further monetary tightening in the USA. Although the rupiah should depreciate a bit as we go towards the end of the year, it is set to finish the year at a stronger level than it started.

Although a September 2016 Fed Funds Rate hike seems off the table (at least - reading the Federal Reserve's July minutes - Fed officials seem to disagree about the timing of higher interest rates), the US central bank is still expected to tighten its monetary policy later this year, a move that will surely lead to capital outflows from emerging markets, including Indonesia. Rising US dollar demand ahead of - and shortly after - another US interest rate hike will put pressure on the Indonesian rupiah and therefore the rupiah is estimated to end the year around the level of IDR 13,300 per US dollar, slightly weakening from its current position.

There have been a number of domestic factors that contributed to inflows into Indonesia so far this year. Investors have been positive about Southeast Asia's largest economy due to the country's improving economic fundamentals: inflation has eased to between 3 - 4 percent (y/y), the current account deficit is stable, the nation's GDP growth finally showed a good sign of acceleration in Q2-2016, while President Joko Widodo has been eager to implement various reforms through economic policy packages, the tax amnesty program and cabinet reshuffles.

Economic Stimulus Packages of the Indonesian Government:

| Package | Unveiled | Main Points |

| 1st | 9 September 2015 |

• Boost industrial competitiveness through deregulation • Curtail red tape • Enhance law enforcement & business certainty |

| 2nd | 30 September 2015 |

• Interest rate tax cuts for exporters • Speed up investment licensing for investment in industrial estates • Relaxation import taxes on capital goods in industrial estates & aviation |

| 3rd | 7 October 2015 |

• Cut energy tariffs for labor-intensive industries |

| 4th | 15 October 2015 |

• Fixed formula to determine increases in labor wages • Soft micro loans for >30 small & medium, export-oriented, labor-intensive businesses |

| 5th | 22 October 2015 |

• Tax incentive for asset revaluation • Scrap double taxation on real estate investment trusts • Deregulation in Islamic banking |

| 6th | 5 November 2015 |

• Tax incentives for investment in special economic zones |

| 7th | 4 December 2015 |

• Waive income tax for workers in the nation's labor-intensive industries • Free leasehold certificates for street vendors operating in 34 state-owned designated areas |

| 8th | 21 December 2015 |

• Scrap income tax for 21 categories of airplane spare parts • Incentives for the development of oil refineries by the private sector • One-map policy to harmonize the utilization of land |

| 9th | 27 January 2016 |

• Single billing system for port services conducted by SOEs • Integrate National Single Window system with 'inaportnet' system • Mandatory use of Indonesian rupiah for payments related to transportation activities • Remove price difference between private commercial and state postal services |

| 10th | 11 February 2016 |

• Removing foreign ownership cap on 35 businesses • Protecting small & medium enterprises as well as cooperatives |

| 11th | 29 March 2016 |

• Lower tax rate on property acquired by local real estate investment trusts • Harmonization of customs checks at ports (to curtail dwell time) • Government subsidizes loans for export-oriented small & medium enterprises • Roadmap for the pharmaceutical industry |

| 12th | 28 April 2016 |

• Enhancing the ease of doing business in Indonesia by cutting procedures, permits and costs |

Various sources

Although Widodo has launched a series of reforms, not all of these reforms have had the success that was hoped for. Weak cooperation and coordination between the central and regional governments have somewhat undermined the success of the 12 policy packages that have been unveiled since September 2015. Similarly, the tax amnesty program has experienced a very slow start. During the first month, the nine-month program only achieved 0.4 percent of the government's target. So far, only IDR 1.24 trillion (approx. USD $95 million) in offshore assets have been repatriated into Indonesia under the program. Earlier, Indonesian authorities stated that they expect the peak of tax declarations and asset repatriations to occur around October. However, the slow start of the program gives ample room for concern.

Another positive matter is that the Indonesian government sent a realistic 2017 state budget draft proposal to the nation's parliament. This proposal includes a relatively low tax revenue target (most likely on the advice of new Finance Minister Sri Mulyani Indrawati). In recent years Indonesia saw a widening gap between government tax revenue targets and tax revenue realization. This issue managed to undermine Indonesia's fiscal credibility.

Indonesia's Tax Collection Target and Realization 2008-2016

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| Target (in IDR trillion) |

534.5 | 597.5 | 661.4 | 878.7 | 885.0 | 995.2 | 1,072.4 | 1,294.3 | 1,318.9 |

| Realization (in IDR trillion) |

607.4 | 563.2 | 650.0 | 872.6 | 835.3 | 916.3 | 985.1 | 1,055.6 | 538.2¹ |

| Balance (in IDR trillion) |

72.9 | 34.3 | 11.4 | 6.1 | 49.7 | 78.9 | 87.2 | 238.6 | |

| Realization (%) |

106.9 | 90.9 | 98.3 | 99.3 | 94.4 | 92.1 | 91.9 | 81.6 |

¹ per 6 August 2016

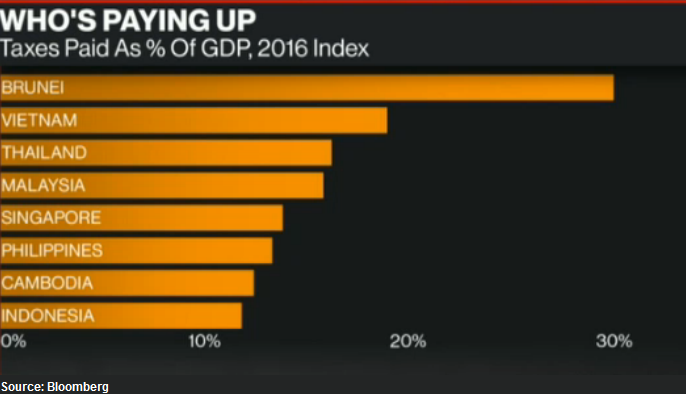

Indonesia's tax revenue is not only plagued by low commodity prices and sluggish profit of companies amid the economic slowdown between 2011 and 2015, but also by the structural low tax compliance. The nation's tax-to-GDP ratio is only around 12 percent, among the weakest worldwide.

At Bank Indonesia's August policy meeting, which is concluded today, the central bank is expected to cut the benchmark interest rate by 25 basis points, a move that provides some deflationary pressures on the rupiah. Moreover, the central bank will adopt a new benchmark monetary tool at this meeting: the 7-day reverse repurchase rate.

Overall, Bank Indonesia is expected not to allow too much rupiah appreciation as that could exacerbate Indonesia's already weak export performance.