Commodity Watch: Influence Indonesian Export Ban on Nickel Price Short-Lived

At the start of 2014 Indonesia introduced its long-planned export ban on raw mineral ores in a bid to strengthen the domestic economy by reducing its dependence on raw commodity exports and instead forcing miners to process their raw ores domestically before exporting is allowed. Being an important global supplier of certain ores, this new Indonesian rule (stipulated by Law No.4/2009 on Coal and Mineral Mining) has a considerable impact on global markets and prices, one of which being nickel.

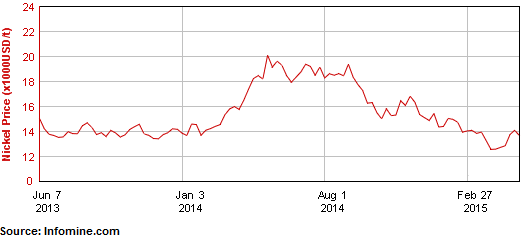

After Indonesia’s export ban became effective in January 2014, the global nickel price immediately soared as markets anticipated lower supplies. However, when we take a look at the graph below, we see that the large nickel price increase that occurred in the first half of 2014 has been neutralized. In fact, the current nickel price is back at the same level where it left off at the start of 2014, implying that the Indonesian export ban only had a temporary effect on the global nickel price and that the global supply is still outpacing demand. This development is contrary to analysts’ initial assumptions who expected to see a longer-term higher nickel price.

Global Nickel Price:

The global nickel price has declined in recent years primarily on reduced demand from China, the world’s second-largest economy. Decreasing construction activity in China and stalling economic growth curbed demand for steel and thus nickel as well because nearly half of China’s nickel imports are used to manufacture steel that is used in construction.

China’s economic expansion touched a 24-year low in 2014 at 7.4 percent (y/y). In 2014 China’s imports of nickel ore fell 33 percent to 47.76 million metric tons according to China’s General Administration of Customs.

Still, it is remarkable that the Indonesian export ban only led to a short-term nickel price increase. Some reports, but these are not confirmed or backed by evidence, claim that illegal nickel shipments from Indonesia caused that the global nickel supply increased. It has also been said that China used part of its vast nickel reserves when the nickel price was high in mid-2014 hence putting downward pressure on the international nickel price.

As China’s construction activity as well as the world economy remains sluggish, chances are big that the international nickel price will not have much room to rise in the remainder of 2015.

Indonesia Plans Higher Tax on Steel Imports

Meanwhile, Indonesian manufacturers of steel pipes object to the Indonesian government’s plan to raise the tax on imports of steel to 15 percent (for steel from Most Favored Nations) from currently between zero and five percent. Through the higher import tax the government aims to protect and boost the domestic steel industry. However, domestic steel pipe manufacturers object as the higher tax would cause higher prices hence making Indonesian steel pipes less competitive on the international market.