Bank Indonesia: Current Account Deficit Improved in 3rd Quarter 2014

The wide current account deficit of Indonesia is expected to have eased in the third quarter of 2014. According to information from the country’s central bank, the current account deficit narrowed to 3.1 percent of gross domestic product (GDP) in Q3-2014 from 4.27 percent of GDP in the previous quarter. A deficit below the level of 3 percent of GDP is generally regarded as a sustainable level. The improvement in Q3-2014 is mainly due to resumed mineral exports after the government and several miners managed to finalize renegotiations.

Giant copper miners Freeport Indonesia and Newmont Nusa Tenggara have been able to resume copper concentrate exports after renegotiating their contracts. Earlier this year, in January 2014, Indonesia banned exports of mineral ore - part of the 2009 Mining Law - in an effort to support the development of domestic processing facilities. However, the government has given some room for the continuation of mineral ore exports (under certain conditions, which includes the development of smelters) up to 2017. Being a major supplier of raw commodities, the new Mining Law impacted negatively on Indonesia’s export performance, thus leading to extra pressures on the trade balance. However, after several miners have finalized renegotiations with the government, the country’s export performance will improve in the second half of 2014.

Bank Indonesia Governor Agus Martowardojo commented on the current account deficit saying that the deficit has improved in the third quarter. In November the central bank will release official data about the Q3-2014 deficit.

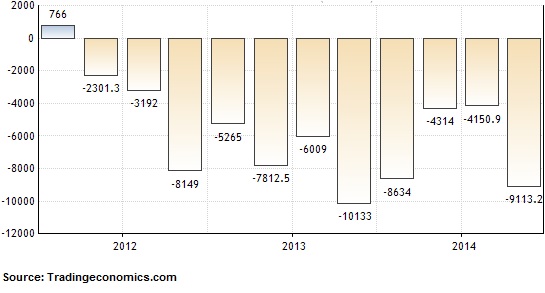

Current Account Balance Indonesia (in USD million):

In the second quarter of 2013, Indonesia’s current account deficit reached a record high at USD $10.1 billion. One year later, the deficit eased to USD $9.1 billion despite weak coal and crude palm oil prices as well as reduced mineral ore exports. According to Martowardojo that is a good sign. The deficit is expected to improve further after the new government has raised prices of subsidized fuels before the year-end. Costly oil imports (to meet domestic fuel demand) is the primary reason for the deficit. President Joko Widodo is expected to raise subsidized fuel prices by about IDR 3,000 per liter (a 50 percent price hike) in November.

The wide current account deficit makes Indonesia vulnerable to capital outflows in times of global shocks (for example the looming US interest rate hike).